Maximizing Your Retirement Strategy: Using IRC Section 7702 Over a 401(k)

Maximizing Your Retirement Strategy: Using IRC Section 7702 Over a 401(k) with Valor Life Group

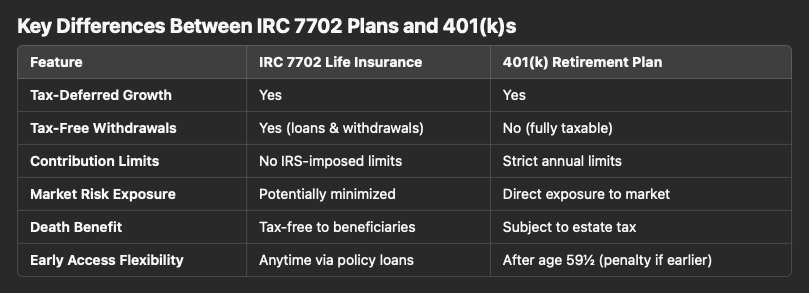

When planning for retirement, most people default to traditional vehicles like a 401(k). While these plans are popular, they are not always the most efficient option for maximizing long-term financial security. An alternative worth exploring is leveraging Internal Revenue Code (IRC) Section 7702 through a properly structured life insurance policy. With Valor Life Group as your financial consultant, you can unlock unique advantages that 401(k) plans cannot offer.

Understanding IRC Section 7702

IRC Section 7702 defines the tax treatment of life insurance contracts in the United States. Specifically, it ensures that certain life insurance policies maintain favorable tax treatment if they meet specific criteria related to cash value accumulation and insurance protection.

A policy that qualifies under IRC 7702 provides tax-deferred growth, tax-free withdrawals through loans, and a tax-free death benefit to beneficiaries. These features can position such policies as a powerful retirement planning tool when properly structured.

Why Choose IRC Section 7702 Over a 401(k)?

Tax-Free Income in Retirement: Unlike 401(k) withdrawals, policy loans under IRC 7702 are typically tax-free if the policy is properly maintained.

No Contribution Caps: While 401(k)s have annual contribution limits ($22,500 in 2024, or $30,000 if over age 50), life insurance policies under IRC 7702 have no such restrictions.

Guaranteed Legacy Planning: Life insurance offers a guaranteed death benefit, ensuring your beneficiaries receive tax-free proceeds.

Protection from Market Volatility: While 401(k) investments fluctuate with the market, a life insurance policy can offer guaranteed minimum returns depending on the contract.

Creditor Protection: In many states, life insurance cash value is protected from creditors, unlike 401(k) accounts, which may have limited protections.

Working with Valor Life Group

Valor Life Group specializes in customized retirement planning strategies, leveraging IRC 7702-compliant life insurance policies. Their team of financial experts provides:

Comprehensive Analysis: They assess your unique financial situation and retirement goals.

Policy Structuring: Valor Life Group ensures policies are designed for maximum cash value accumulation and tax efficiency.

Ongoing Support: They offer continuous policy management and adjustment as your financial needs evolve.

Is IRC 7702 Right for You?

While IRC 7702 offers compelling advantages, it isn’t for everyone. Factors like age, health status, and long-term financial goals play a crucial role in determining if this strategy makes sense. Consulting with a knowledgeable firm like Valor Life Group can help you make an informed decision.

Conclusion

While a 401(k) is a well-known retirement vehicle, it may not be the most efficient option for everyone. IRC Section 7702 offers flexibility, tax advantages, and legacy planning that a traditional 401(k) cannot match. Contact Valor Life Group today to explore how an IRC 7702-compliant life insurance policy can transform your retirement strategy into a tax-efficient, legacy-preserving financial plan.