Retire on YOUR terms. Let us help you achieve your financial dreams.

Use the same approach as these Famous American Entrepreneurs!

-

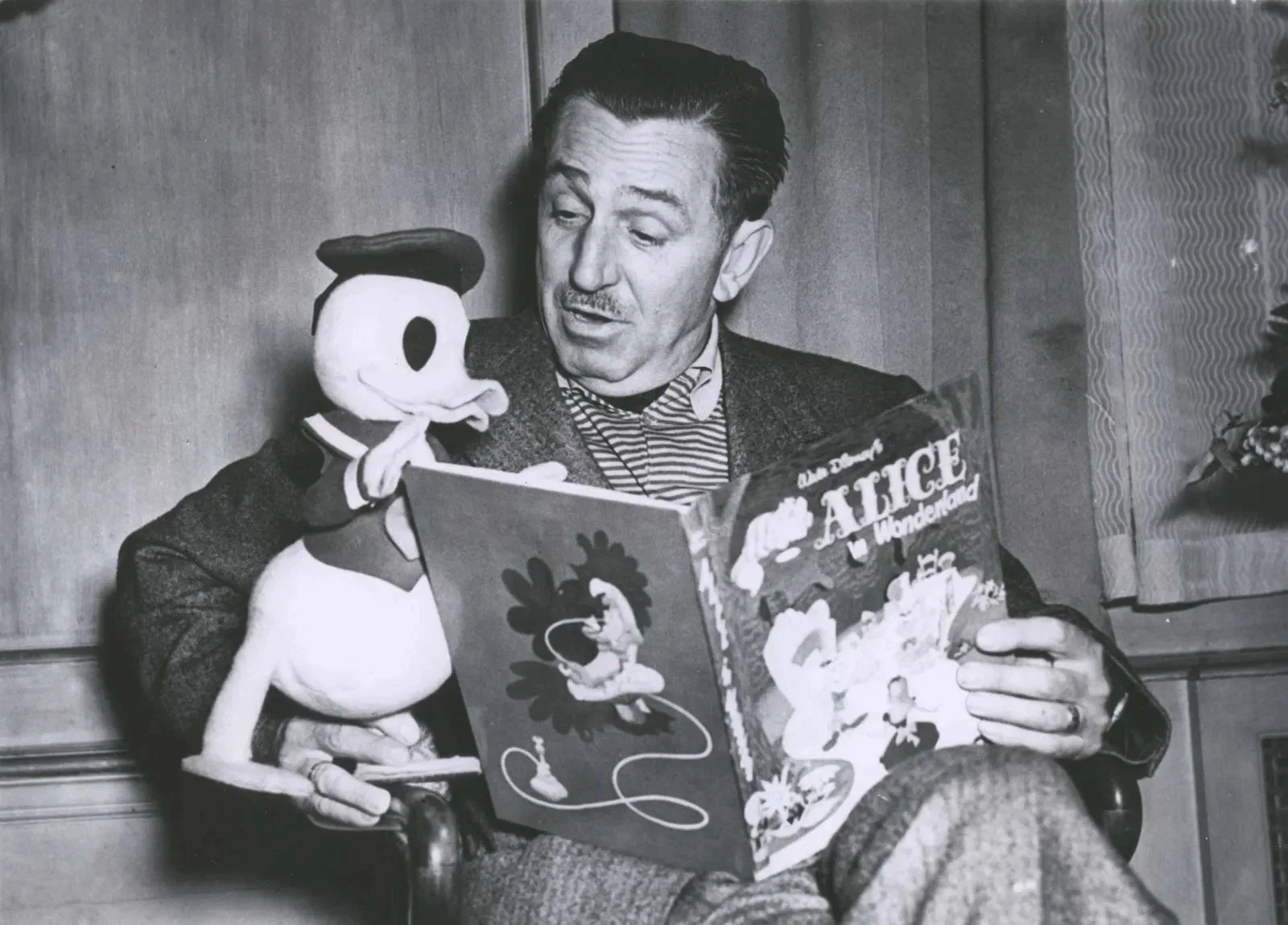

Walt Disney – Financing the Magic Kingdom

When Walt Disney dreamed of creating Disneyland, traditional lenders doubted his vision. To secure financing, Disney borrowed against his life insurance policy’s cash value. This funding helped transform 160 acres of California farmland into what is now one of the world’s most beloved entertainment destinations.

-

J.C. Penney – Saving a Retail Empire

During the Great Depression, J.C. Penney’s retail business faced severe financial struggles. With banks unwilling to lend, Penney borrowed against his life insurance policy’s cash value to meet payroll and stabilize his business. His foresight helped the company survive one of the toughest economic times in American history and grow into a national retail giant.

-

Ray Kroc – Expanding McDonald’s

Ray Kroc, the force behind McDonald’s global expansion, used life insurance policies as collateral to fund McDonald’s early growth. His strategic use of this financial asset helped transform a small burger stand into the world’s largest fast-food chain, demonstrating how entrepreneurs can use life insurance to scale businesses.

-

Doris Christopher – Launching Pampered Chef

Doris Christopher, founder of Pampered Chef, used a life insurance policy loan to start her business from her home kitchen. This initial capital allowed her to fund product development and marketing. Her business eventually grew into a multimillion-dollar enterprise, later acquired by Berkshire Hathaway.

Frequently Asked Financial Questions

-

Is a 401K the best plan for me?

While a 401(k) is a popular retirement savings option, it might not be the best fit for everyone. Factors like your career path, employer contributions, and long-term goals can make other plans more suitable. Discover how to align your retirement strategy with your unique financial journey.

-

What Other Plans Exist?

The world of retirement planning goes far beyond the 401(k). From IRAs to HSAs, annuities, and more specialized accounts, there are plenty of options tailored to different financial needs and lifestyles. Learn which plans could unlock new possibilities for your future.

-

Are Indexed Products Risky?

Indexed products offer growth potential with downside protection, but how safe are they really? Understanding the balance between returns, market performance, and security can help you decide if indexed products are the right fit for your portfolio.

-

Does Health Matter for Investments?

Your health can directly impact your financial future. Medical expenses, life expectancy, and even insurance rates play a critical role in investment planning. See how factoring in your well-being can strengthen your long-term financial outlook.

-

Does My Military TSP Account Transfer?

Transitioning out of the military comes with many financial considerations, including what happens to your Thrift Savings Plan (TSP). Learn how to manage, transfer, or roll over your account for maximum retirement benefit as you move forward in your career.

-

Are There Tax Advantages with Investment Accounts?

Smart investing isn’t just about growth—it’s also about minimizing taxes. Different accounts, from Roth IRAs to HSAs and taxable brokerage accounts, offer unique tax benefits that can boost your wealth over time. Discover how strategic investing can help you keep more of what you earn.

How We Help Solve your Problems!

-

Tax Free Retirement Income

We can provide versatile financial tools that combine life insurance protection with potential cash value growth. It offers flexible premiums, tax advantages, and market-linked returns.

-

Mitigate Market Volatility

We have multiple effective solution by offering growth potential while safeguarding against market downturns. In the dynamic world of finance, ensuring a stable and reliable income for retirement is crucial.

-

Guaranteed Gains - No Risk of Loss

Achieving a secure and stable retirement requires financial products that provide both security and consistent returns. This is an excellent choice for those looking for guaranteed interest rates over a fixed period.