Using an Indexed Universal Life (IUL) Policy as an Alternative to a 401(k)

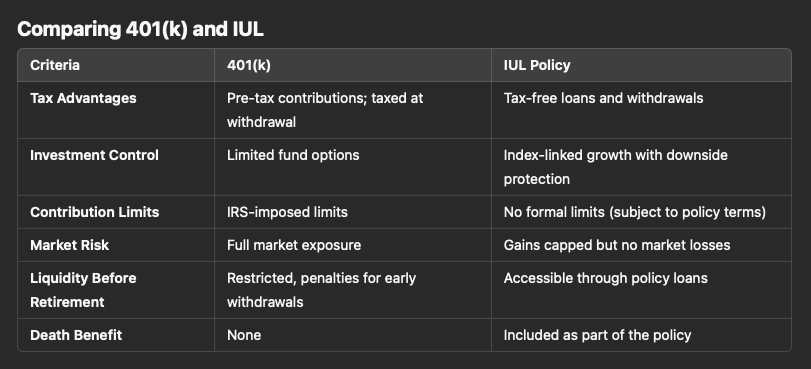

Planning for retirement can be challenging, especially when navigating the maze of investment options. Two popular choices are the traditional 401(k) and the Indexed Universal Life (IUL) insurance policy. While many are familiar with a 401(k), fewer understand the potential benefits of an IUL as a retirement vehicle. This article explores both options, contrasts their features, and highlights why consulting experts like Valor Life Group can be invaluable.

What is a 401(k)?

A 401(k) is an employer-sponsored retirement savings plan that allows employees to invest a portion of their pre-tax income into various investment funds, typically mutual funds. Contributions grow tax-deferred, and many employers offer contribution matching.

Key Features of a 401(k):

Tax-Deferred Growth: Contributions reduce taxable income, but withdrawals in retirement are taxed as ordinary income.

Employer Matching: Many employers match a percentage of employee contributions.

Contribution Limits: The IRS sets annual contribution limits.

Withdrawal Rules: Early withdrawals before age 59½ incur a 10% penalty and are subject to income tax.

What is an Indexed Universal Life (IUL) Policy?

An IUL is a type of permanent life insurance that combines a death benefit with a cash value component. The cash value grows based on the performance of a market index, such as the S&P 500, offering potential gains with downside protection.

Key Features of an IUL:

Cash Value Growth: Linked to market index performance, with a guaranteed minimum to prevent losses.

Tax-Free Withdrawals: Policyholders can access cash value tax-free through loans or withdrawals.

Flexibility: Policyholders can adjust premiums and death benefits.

Lifetime Coverage: Unlike term insurance, IULs last for life as long as premiums are paid.

Benefits of Using an IUL Over a 401(k)

Tax-Free Retirement Income: Withdrawals from an IUL, taken as loans, are tax-free, unlike taxable 401(k) distributions.

Market Downside Protection: An IUL guarantees no loss of principal due to market declines.

Flexible Premiums and Contributions: There are no rigid contribution limits like in a 401(k).

Lifetime Coverage and Legacy Planning: An IUL provides a death benefit that can help with estate planning.

Access to Funds Anytime: Policyholders can access funds without penalties, offering greater liquidity and financial flexibility.

Why Choose Valor Life Group?

Navigating the complexities of retirement planning requires expert guidance. Valor Life Group specializes in helping individuals optimize their retirement strategies using tools like IUL policies. Their consultants provide personalized strategies that align with long-term financial goals, ensuring you make the most informed decisions for a secure retirement.

Conclusion

While 401(k) plans are well-known, they come with significant limitations, including contribution caps, market risks, and taxation upon withdrawal. An IUL policy offers a more flexible, tax-advantaged alternative with market-linked growth and protection from losses. To determine if an IUL is the right fit for your retirement strategy, consult the experts at Valor Life Group and take control of your financial future today.